Picture for a moment that an enterprise you start today, in 2022, should live to see the light in 2341: that’s 319 years from now, precisely the same length of time that Royal Joh. Enschedé has been in business. It’s safe to say that since its inception, the three century-old Dutch security printer has lived through quite the rollercoaster of upheavals and innovations on a global scale. Could you imagine telling Izaak Enschedé in 1703 that the same company that printed the “Robin,” the very first Dutch banknote, would one day be researching how to mint paper money as NFTs? Or, again, how to ensure virtual banknotes in the metaverse can contribute to a safer, more trustworthy, and ultimately counterfeit-free world?

Izaak Enschedé would have probably been none the wiser by the end of it, but it surely would have made for an interesting conversation.

The backbone of innovation is the simple truth that things seem impossible -or useless, and sometimes both- until they don’t. And suddenly, that’s when everything changes. Well, when it comes to the very concept of money, the internet, and the way we interact with one and the other, we seem to be living through the latter phase. It remains to be seen how structural question marks relating to the metaverse, cryptocurrencies, and Web 3.0 will come to evolve, but we can begin to see the future shaping before us a lot more clearly than we could have only a few years ago. We can now make some informed predictions for example, that virtual banknotes could become the official (although that in itself is an interesting concept, considering the decentralized nature of Web 3.0 ideals) currency of the metaverse.

In 2009, when Bitcoin was first released and Meta was not only still named Facebook, but in its absolute infancy, that would have seemed a pretty absurd sentence, but it’s not anymore. PWC predicts that “the metaverse will significantly contribute to the global economy,” in fact, by adding a total of $1.5 trillion by the year 2030.

So, once the technology for it catches up and gives us enough time to get used to the idea of our virtual avatar interacting with other avatars in a virtual world, we’ll probably be asking ourselves the same question that every society before us did: how do we exchange goods in this new reality? How do we sell, transfer, lend, borrow, and do it all in a safe and secure way? And as we merge digital with physical, how do we ensure the crossover is as frictionless as possible?

It is very likely that this will look like a combination of well-known cryptocurrencies as well as native means of payment under control of the virtual space in question. But with some metaverses becoming increasingly life-like, the appeal of native banknotes will begin to increase ––for example, in order to reduce friction between virtual and “real life” events, such as concerts, expos, conferences, sporting events and more, where a native bank note in physical form may be combined with a corresponding NFT in virtual environments.

So, for example, a wide variety of applications could be linked to the corresponding NFT, adding to the monetary value for which the physical banknote is purchased –perhaps providing access to a Formula 1 race, or entry to Tomorrowland festival. Whether a few banknotes guarantee basic features or exclusive VIP treatment (in real life) could depend on its value (in the metaverse,) which can decrease or increase based on specific utility. The possibilities for this, in a new era of security and trust in the online world, are truly endless.

Security guaranteed

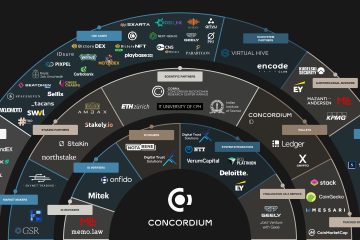

Of course, by their very nature, physical banknotes have to comply with the highest security requirements to prevent fraud. In the metaverse, security can be guaranteed by an ID framework at the protocol level, which is something that the science-based Concordium blockchain provides. This guarantees privacy and security while, at the same time, allowing every transaction to be monitored, which is vitally essential in the case of virtual bank notes. It also allows for low transaction costs and fast transaction times, meaning that one can immediately trust the process has been successfully executed and without errors.

And, most importantly, it will always happen with utmost accuracy and transparency. Ridding the world of counterfeit, as security printers know all too well, is a challenging feat. Modern technology has made it easier, with special features like augmented reality, RFID-chips for track & trace and unique coding to prevent re-use, but it hasn’t been able to solve the problem. Now, blockchain technology is finally bringing us one step closer.

Its metaverse applications could revolutionize the way we think about -among other things- the value of physical notes in the digital world, which, in turn, might ensure their survival in the predominantly (or entirely) digital world we are fast approaching. But in order for that reality to fully manifest, we must ensure it is built on a safer, more trustworthy, and ultimately counterfeit-free foundation. We have no way of knowing what Izaak Enschedé would think of the way the world looks like in 2022, but he might have liked the idea of banknotes adapting with the times ––even if that means they become pixelated and speak in code rather than ink.

0 Comments