NFT is still at the beginning of development and is already taking over the business to consumer (B2C) market! It is only a matter of time before NFT is introduced in the B2B market. The question is: Are you ready for yet another innovation?

Everything about blockchain comes in waves and cycles, and the Non-Fungible Token craze is no exception. The hype in the first half of 2021, when many celebrities rushed to cash in on it, is dying out a bit. Yet the NFT ‘funeral’ reports that began to circulate were premature, as were the reports of Bitcoin’s imminent demise.

The entire blockchain ecosystem is currently made up of both hypes and adaptive adaptations in the market. From Beeple raising $69 million in the famous Christie’s auction to celebs, influencers, athletes, musicians and artists issuing their own collectibles. As a result, the NFTs sector has now become relevant in the blockchain universe. More and more NFT marketplaces, dApps and other blockchain solutions are entering the ecosystem and the market is flooded with thousands of new digital NFT collectibles every week. NFTs are here to stay!

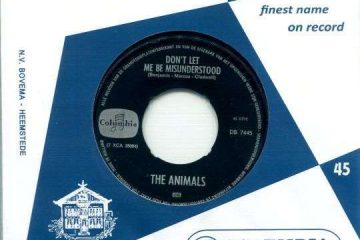

NFTs first came into the spotlight in October 2017 with the launch of CryptoPunks, the world’s first “rare digital art” marketplace. At the time, they were ordinary NFTs, with very little name recognition outside the hardcore blockchain world. Fast-forward to 2020 when 30,000 to 80,000 NFTs changed hands every week. But it wasn’t until 2021 that the boom times really began. A recent report from nonfungible.com states that more than $2 billion was spent on NFTs during the first three months of 2021 – an increase of 2,100 per cent compared to the fourth quarter of 2020.

DappRadar estimates that NFTs generated $1.2 billion in sales in July 2021 alone; more than half the cumulative sales volume of $2.5 billion in the first two quarters of the year. Daily trading volume on the OpenSea NFT marketplace exceeded $49 million on August 1.

The catalysts behind the growth

One of the main reasons why the NFT trend and growth is so spectacular is that it is changing the value proposition for creators. Instead of using a publisher, gallery or record label to sell creative works, artists are now able to capture a larger share of the overall profits. This paradigm shift also breaks down the traditional relationship between consumers and creators. The rise of crypto billionaires and investors with lots of money to spend also plays an important role, as owning a digital artwork becomes more and more mainstream culture and to some extent even a status symbol. Take the rise of the bored ape avatars on Twitter accounts of The Bored Ape Yacht Club. As the demand for NFTs increased, marketplaces flooded the market, contributing significantly to adoption and accessibility for collectors – but less so for artists.

Until recently, the Ethereum network was the only blockchain that supported the minting of NFTs (the process of creating an NFT), but the network faced capacity and cost issues that increased the cost of minting NFTs. The development of new chains such as Binance Smart Chain (BSC), Concordium, Cosmos, EOS, Polkadot and others led to lower costs, but even these still fail to address the real problem of usability for newcomers to the blockchain. The process for mining and trading NFTs themselves is far too complicated. However, better solutions are emerging such as Unifty where less tech-savvy artists (or anyone else) are able to design, create, manage and trade NFTs themselves.

Celebrity influence drives NFT market to great heights

The NFT market is to some extent driven by rarity. With the influx of celebrities and influencers, platforms like Ethernity started producing limited-edition NFTs of artists and “personalities”.

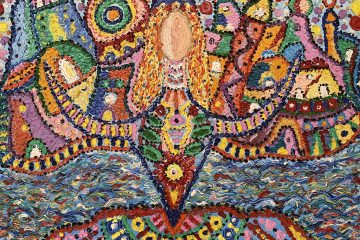

This accelerated the celebrity NFT culture, a trend that is still growing by leaps and bounds. The platform recently introduced a new form of NFTs – limited-edition authenticated NFTs, which are endorsed by prominent celebrities but made by real artists. The beauty of the NFTs shines through with boundless ideas. For example, Lithuanian street art collective KIWIE has created a series of NFTs where street art has been transformed into NFTs that are linked to the GEO coordinates of the actual art. Owners of the NFTs also own the actual street art. Another important factor behind the surge in demand is that NFTs are no longer limited to art. The horizons of NFTs have now broadened further to include music, videos, sports and especially gaming.

The footprint of the play-to-earn (P@E) gaming revolution

In 2017, decentralised gaming company Enjin was one of the first mainstream gaming companies to understand (and start harnessing) the value of gaming and blockchain. It merged blockchain technology with its infrastructure and also issued a gaming cryptocurrency, ENJ, which is officially whitelisted for use in Japan. Another important piece of the NFT adoption puzzle ie the P2E, or play-to-earn. Games such as Axie Infinity and Splinterlands allow users to mine rare in-game assets as NFTs. Players can buy, sell and trade these items. Data on DappRadar shows that Splinterlands alone generated more than 4 million transactions per day on August 7, 8 and 9 – while the entire Ethereum network generates an average of 1.2 million transactions per day. Now gamers are able to generate revenue through their in-game assets in NFT form. As a result, the play-to-earn blockchain gaming model has established itself as an immense growth opportunity for NFTs. For gamers from third world countries, these blockchain-based games can serve as more than just games. According to Forbes, Axie Infinity experienced strong user growth in the Philippines as it offered players an alternative source of income during the pandemic.

The bright future for NFTs

The first wave of NFTs was a great testing ground for Ethereum’s technology, but mainly for its digital art potential. Now we are entering a second phase for NFT applications with new use cases. Fuelled by the pandemic and the influx of user-friendly and cost-efficient NFT platforms, protocols, marketplaces and the rising demand of the gaming industry, the NFT market is definitely here to stay and is the preferred choice of the new digital generation. “It’s actually much easier than you think,” says Paris Hilton, who loves to explain the world of NFTs. Until now, she was never considered a major player in the art world. In 2008, Damien Hirst bought a portrait of her by the artist Jonathan Yeo, in which her body is made up of images cut out of porno magazines.

For the proponents of the NFT world, technology offers a revolutionary new way to sell art and bypass the snooty cultural gatekeepers. In this context, the relevance of Hilton’s brand to the NFT movement can also be explained. Pink, jewelled and openly motivated by being as rich and famous as possible, she is far removed from the kind of people whose work is usually exhibited in blue-chip galleries or hung in stands at art fairs.

Yet Hilton’s support may also be ammunition for those who see the NFT as yet another bad example of the speculative logic of money. For its detractors, from critic Waldemar Januszczak to artist David Hockney, the NFT marketplace is a sanctuary for morally bankrupt, environmentally vandalistic money grabbers whose creations hardly qualify as art.

While most of us are still grappling with what exactly “fungible” means, there is a struggle going on to define how NFTs should be understood. Are they a vital cultural product that tells us something profound about digital consumerism? Or are they just the latest cynical way to make absurd amounts of money?

In March, the crypto company Injective Protocol paid $95,000 for Morons, a physical artwork by Banksy depicting an auctioneer selling a framed photograph with the words, “I can’t believe you idiots are buying this shit.” The photo was then burned and a digital copy of the work sold for $380,000. The event was a marketing ploy, designed to stir up outrage, generate publicity and make a profit. Yet the symbolism was powerful: digital art is here to replace its physical predecessor, and its coming supremacy is to be reflected in a higher price tag.

In essence, an NFT is a digital certificate of ownership, almost always bought and sold with cryptocurrency, to which any digital file – a jpeg image file, a video, a song, a document – can be attached. That Pairus Hilton can display Iconic Crypto Queen in her home, despite having sold it, is part of the appeal of the NFT – and the challenge it poses to the established business model of trading and accessing art. With a simple Google search, anyone can find and download the file that belongs to an NFT for nothing, and save it to their phone or computer, but only the owner has the right to sell it. Each NFT is unique, and all transactions are tracked on the blockchain, a kind of database invented in 2008 to record the movements of cryptocurrency.

In March, ‘Everydays: The First 5000 Days’, a collage of previous artworks by a 40-year-old American named Mike Winkelmann, better known as Beeple, sold for $69.3 million at Christie’s New York. Then Kate Moss sold a gif of herself for more than $17,000. Jack Dorsey, CEO of Twitter, sold an image of the very first tweet for $2.9 million. A Brooklyn film director managed to sell an audio file of his own farts for $85. Dominic Cummings even threatened to use the technology against Boris Johnson, releasing what he said was evidence of government wrongdoing in the form of an NFT. But NFTs can be used on a much larger scale, albeit not in such a flashy way. They have many practical business applications. At least, they could, once some important problems are solved.

What makes an NFT special?

An NFT is a digital object – some computer code and data – that transfers ownership of something. The ownership can be online, like virtual real estate in a digital world or a special outfit in a video game. It can also be something real: real property, a painting, or a seat at a concert. An NFT could also be a hybrid form, such as the right to decide who can rent a room in a cooperative housing facility (something a San Francisco entrepreneur tried, but found no takers until the end of May 2012). Conceptually, this is old. Contracts, deeds, shares, titles, logins for cloud-hosted software applications – even the dog tag of a pet and many other mechanical and digital methods have conveyed and proven ownership as long as there has been commerce. This is no different from almost any other technology. Cars took over from horse and cart. Computers, in specific ways, replaced pencils, paper, accounting journals, human activity, and much more.

Like any technology, NFTs can provide more efficient ways of doing business. For example, they work with the crypto-technology blockchain – a distributed digital ledger that does not necessarily need a central system to function. Transactions can take place more quickly and easily. Secondly, the blockchain also keeps a record of all transactions related to the NFT and the property it represents. When selling art, for example, it can represent the provenance of something going back to its creator. Thirdly, NFTs may contain so-called smart contracts, or coded elements that can take actions automatically under certain conditions. The concept is that of an automated and self-enforcing set of rules that cannot be ignored or skipped.

But then there is reality. The technology first emerged in 2014 and has only started to attract mainstream attention in the last few years. This limited time ren application in the use of NFTs also means limited time for troubleshooting and experts to come up with solutions. We are opening a Pandora’s box and we are only at the beginning of a new era!

Free translated from SOURCE

0 Comments