NFTs are a topic of discussion hard to escape from these days. Either because of multi-million dollar sales, non-fungible tokens have entered the mainstream world for good. But while the majority of us will think of digital art, music, fashion and the metaverse as the main areas of application of this technology, physical NFTs are also carving out a space of their own in crypto.

Here’s a closer look at what they actually stand for and how they are already being used.

Before we get into the nitty gritty of things, let’s break down the concept of ‘fungibility’. An item that is fungible is something that can be exchanged for something else with the same exact value. Money is a great example of fungibility as, for example, a € 10 Euro bill can be exchanged for another bill of the same value, or even swapped for smaller bills that would still add up to € 10 Euro.

A non-fungible item is something that is completely unique and as such can’t be exchanged for anything else of an equal value. Now that you know this, getting to the bottom of NFTs will be easier. A non-fungible token, or NFT, is a type of digital asset that can be proved to be unique and is not interchangeable because no other asset can ever hold the same value. This is why these tokens are called non-fungible. Typically, the record of the uniqueness of the NFT exists on a blockchain and is secured using cryptography.

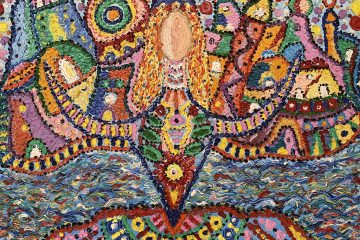

NFTs can be seen as the digitized information about an asset, digital or physical, or as a digital asset in and of itself. For example, an artist can create copies of their physical artworks, like paintings or sculptures, and sell them as NFTs in a dedicated marketplace. Currently, non-fungible tokens are most popularly used in gaming, digital art, music, sports collectibles and the metaverse, but potential applications are much wider (and yet unexplored).

Some of the core characteristics that define a non-fungible token include:

Uniqueness and rarity

NFTs are by definition unique and sellers can produce a limited number of non-fungible tokens which, in principle, keeps them scarce and raises their value even further. That would be the case with popular NFT collections like CryptoPunks and the Bored Ape Yacht Club, each containing 10,000 unique NFTs.

Proof of ownership

When purchasing an NFT, buyers get some rights to the underlying digital item, including ownership, although that is not always the case. Blockchain technology allows the ownership of a digital asset to be recorded and be made publicly accessible, making it verifiable at all times. This applies to physical NFTs as well.

Immutability

The information embedded into blockchain-tokens by developers is nearly impossible to be tampered with or in any form compromised. This helps NFTs be a transparent and trustworthy technology.

Programmability

NFTs can be in a number of ways with features like royalties or life which are detailed through NFT smart contracts. There are also experimental applications being explored in DeFi.

What Is A Physical NFT?

NFTs are most commonly associated with the artworld, but non-fungible tokens have been issued and sold as a digital representation of off-chain assets like sports collectibles, antiques or even consumer goods. Here, the NFTs can act as a guarantee of ownership over a real life, physical item if the buyer indeed wants to have a physical version of their property. So in short, a physical NFT is a non-fungible token that is linked to a physical asset. A great example worth mentioning is how famed digital artist Beeple has provided physical tokens connected to his artworks as he himself explains, which will typically include a high-resolution screen art display, a signed certificate of authenticity, cleaning materials and a hair sample (allegedly, don’t take our word for it). In the end, physical NFTs can be sold just like any other non-fungible token or be redeemed for the physical item it is connected to.

How do you link an NFT to a physical item?

Suppose you have a good idea to link an NFT to a physical object, how do you go about it? To keep it simple, let’s take a physical painting. You have to start by creating a ‘digital twin’ of the painting. To do this, you can take a picture of it with your phone – or better still, with a professional camera. Once you have digitised the photo, make sure that all the information (metadata) related to the painting, such as the dimensions, the technique used, the author and much more, is as accurate as possible and added to the virtual file.

Then you choose a reliable NFT marketplace like SpaceZeven to ‘mine’ the painting Briefly explained:

Every Ethereum-based NFT has a so-called ‘smart contract’ or proof of ownership, which records the transferability of the NFTs. It stores every transaction and all unique information related to the digital object on the blockchain where the NFT is managed. With this encoded information, the digitised painting, the NFT, is inextricably linked to the real physical object.

Often, QR codes and NFC tags are the only visible link. Nike, for example, has experimented with digital shoes with a unique identifier that corresponds to a physical pair. It is worth bearing in mind that an NFT cannot be changed after it has been minted, so you will need to capture as many unique details as possible before minting the digital object as an NFT and thereby linking it to the physical object.

Advantages of physical NFTs

The biggest advantage of physical NFTs is the ability to prove authenticity and provenance. In a world where the counterfeit market is estimated to be in excess of $500 billion, physical NFTs can be a valuable tool for buyers and sellers. Thanks to blockchain technology, information linked to virtual assets and their physical counterparts can never be altered, falsified or manipulated, creating a data trail that can be trusted. Even better are the new proof-os-stake blockchains such as Concordium, which have developed their own ID layer on the blockchain, linking not only the data but also the verified identity to the data. This is an absolute must for reliable online business applications. Physical NFTs can also be linked to recurring royalties, so that the first owner receives a percentage each time an object changes hands.

The challenges of linking physical assets to NFTs

As with any emerging technology, physical NFTs also have drawbacks. For starters, legal issues can arise because the buyer of a physical NFT may not have access to the copyright. In some cases, he may not be able to distribute it, share it or even display it publicly. In addition, it is possible to create a physical object such as a sculpture and sell the NFT to one buyer and the physical object to another, without it being linked to the NFT. And then of course there is the problem of fake sales, rogue sellers and hackers, but the emerging proof-of-stake blockchains requiring identification will deter those.

Bottom line

It is clear that NFTs can have a wide range of applications for both digital and physical objects. While most of us will associate non-fungible tokens with big names like CryptoPunks, the Bored Apes or NBA Topshot collectibles, physical NFTs can be applied in real – not digital – life. Like in the supply chain where blockchain technology can provide traceability, authentication and certification guarantees, but also in financial services like loans and policies and for value products like diplomas and deeds. The possibilities are unprecedented. That is also the reason that linking non-fungible tokens to physical assets is seen as one of the biggest applications for the use of NFTs and blockchain technology!

0 Comments